Over the past few years, blockchain has grown to become one of the most influential technologies that has reshaped almost every industry. In fact, it is said to be the “next big thing” after the Internet. However, there is still way to go before it reaches its full potential. In this blog, we discuss some of the major blockchain trends that we expect to see in 2019 and beyond.

“2018 was a tough year, but we have a longer term outlook for our industry. The builders have been building in 2018, so for 2019, I think we will see a lot of real products and real applications coming into the market.”

– Changpeng Zhao (CZ), CEO of Binance, a global cryptocurrency exchange.

Blockchain Technology – What to Expect in 2019?

We are now well into 2019 and increasingly a lot of businesses have now made it a priority to harness the power of blockchain to accomplish their objectives. According to a report from Research and Markets, the world’s leading market research store, the global blockchain market is expected to grow at a CAGR of 42.8% (2018-2023) leading to global revenue of USD 19.9 Billion by 2023.

Looking for blockchain development and consulting services?

Helios offers a complete spectrum of next-gen blockchain solutions.

As the momentum shifts from blockchain exploration to blockchain application development, we explore six blockchain trends to watch out for this year and beyond:

1) Decentralized apps will gain traction

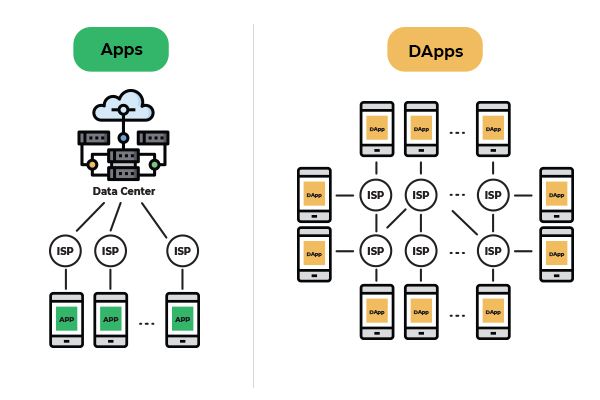

Decentralized applications (DApps) are digital applications that run on a decentralized network with trustless protocols. These applications are outside the horizon and control of a single authority.

The advent of blockchain technology had much to do with DApps. Although there are many scaling issues with blockchain, platforms like Ethereum have made it possible to build seamless DApps that are driven by state-of-the-art ledger technology. With Ethereum Casper Protocol to the rescue, all the problems related to the DApp development will gradually be eliminated and this year will witness a massive adoption of DApps.

State of the DApps, a not-for-profit curated directory of DApps, lists 2,550+ live DApps across the blockchain ecosystem. Some of the most popular ones are Steemit, My Crypto Heroes, MakerDAO, eSteem, and Basic Attention Token.

Are you interested in developing blockchain-based apps?

Helios helps you create blockchain-infused decentralized apps.

2) Businesses will get the most out of hybrid blockchain

In spite of the benefits of decentralization, businesses that operate in highly regulated markets refrain from adopting blockchain. This is because most of the blockchain solutions are unable to accommodate local laws and regulations that tightly control these markets. Hybrid blockchain solves this by making it possible for highly regulated marketplaces to benefit from decentralization while staying compliant with local laws. To better understand a hybrid blockchain, it is important to know the benefits and limits of the existing types of blockchains – public and private.

Public Blockchain:

This type of blockchain is open for the public and anyone can participate in the maintenance and governance of the shared ledger. No single entity can own the network or can centrally store all the data. Participants are typically rewarded in the form of block rewards for their contributions to the network. However, there are security concerns with public blockchain and so is not suitable for highly regulated markets.

Private Blockchain:

This type of blockchain revolves around the concept of permissions. It is not open for everyone and the rights to read or modify the blockchain are restricted to only a few users. In fact, in a private blockchain, participants are known to each other and proven to be trusted. The key issue with a private blockchain is that it not as decentralized as the public blockchain. This is why private blockchains are not suitable for highly regulated markets.

Hybrid blockchain has some characteristics of a public blockchain such as Ethereum, and some of a private blockchain such as Hyperledger. It ascertains that every transaction is private but still verifiable by an immutable record on the public form of blockchain. This makes hybrid blockchain a preferred choice for regulated marketplaces as it offers the best of both worlds.

3) Stable coins will dominate the crypto space

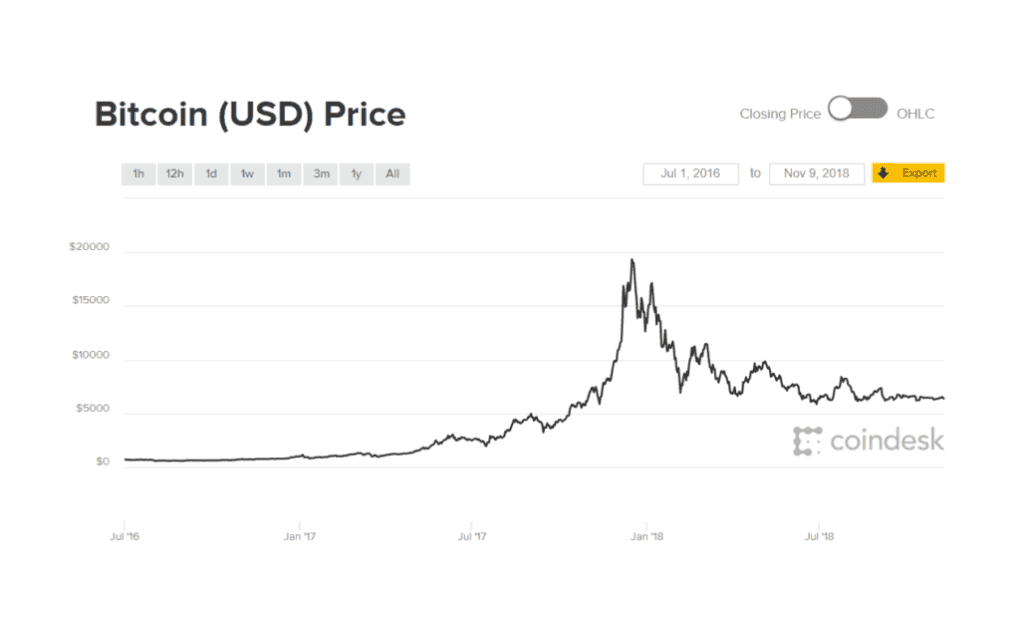

Year 2018 proved to be disastrous for the cryptocurrency market, where the total market value of all cryptocurrencies shrunk by 80% to roughly $200 Billion. This year will be a comeback year for cryptocurrencies, with a much more stable cryptocurrency market.

Last year, cryptocurrency investors became millionaires overnight, only to lose much of their wealth in a matter of weeks. This was mainly because of the highly unreliable nature of crypto assets like bitcoin.

This is where stable coins come into picture.

“Stable coin” is a terminology used to define a type of cryptocurrency that is meant to hold a stable value – The total amount of a stable coin is linked to a real-world asset (in most of the cases it is USD). Some examples include: Tether, Gemini Dollar, USDC, PAX and DAI. The characteristic that separates a stable coin from other cryptocurrencies is that it is not affected by the market condition and remains stable all the time. It provides a simple, yet controversial solution to a major problem related to cryptocurrency: volatility.

Looking to harness the power of blockchain?

Helios helps you explore every aspect of blockchain and build customized solutions.

4) Blockchain will transform social networking

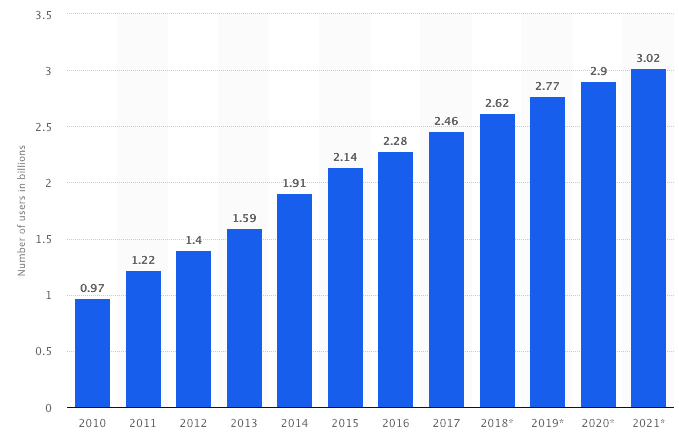

It is no secret that social media platforms have become a crucial part of today’s society. According to Statista, it is estimated that in 2019 there will be around 2.77 Billion social media users around the globe.

Number of social media users around the globe (2010 to 2021)

After growing in popularity for more than a decade, last year, social networking industry endured a series of scandals that significantly tarnished its reputation – the “Russia Scandal”, the “Cambridge Analytica” data leak. These scandals prove that social media platforms are not tamper-proof. In fact, they are plagued with issues such as privacy violation, data control, and content relevance.

Blockchain to the Rescue

A blockchain-based approach to social networking addresses all the above issues by establishing a decentralized approach to connectivity –

- Data Control: Blockchain ensures that whatever data is published on the social network can be traced anywhere it goes and that it doesn’t get duplicated; furthermore, if the owner deletes the data, it gets deleted from the entire system such that no unauthorized third parties can access or benefit from it

- Privacy: With blockchain technology, social media users get the ability to store private information in a secure, decentralized ledger. They can maintain data ownership, deciding when and where it is shared. This prevents the malicious third parties from accessing or harvesting personal data without consent.

- Content Relevance: In the existing social media landscape, the power is completely in the hands of the platform owners like Facebook, Twitter, and Instagram but introducing blockchain into the mix could quickly change that – Blockchain ensures that the social network account holder gets to dictate the type of content to be displayed.

5) Blockchain will be integrated with IoT and AI to create new, unimaginable solutions

To understand how Internet of Things (IoT), Artificial Intelligence (AI), and blockchain can work as one, let us take the example of a human body:

- IoT resembles the nervous system of a human body that senses environmental changes that impact the body and coordinates its actions by transmitting signals to and from different parts of its body

- AI represents the reasoning part of a human brain; it thinks by analyzing data and makes decisions

- Blockchain is similar to human memory that creates a secure, inerasable record of transactions and data exchanges

The integration of IoT, AI, and blockchain can enable organizations maximize the benefits of each of these technologies while minimizing the risks and limitations associated with them. As IoT networks consist of a myriad of connected devices, there are numerous vulnerabilities in the network, leaving it prone to data theft and hacker attacks. To prevent security concerns, AI powered by machine learning can proactively protect against malware and hacker attacks. The security of the network and the data can be further improved by blockchain, which can limit illegal access and modification of the data on the network.

A potential case that demonstrates the integration of IoT, AI, and blockchain is Fujitsu’s algorithm to assess heat stress of workers. The algorithm constantly monitors worker’s physiological data such as activity level, temperature, and pulse using IoT wearable and sensors – when the heat stress levels reach critical proportion then automatically the body sensors detect it. Addition of blockchain ensures prompt insurance. For example, if a worker’s health weakens and the sensor records a high temperature, then the blockchain smart contract would activate the transfer of insurance money from the insurance firm to the worker.

6) STOs will be the future of fundraising

So far in the blockchain space, cryptocurrency projects have been funded by Initial Coin Offerings (ICOs). This revolutionary fundraising mechanism enabled people invest at the ground floor of a new organization or project.

According to ICOdata, world’s biggest and most accurate ICO database, in 2017, there were a total of 875 ICOs that produced over $6 Billion. In 2018, a total of 1,183 ICOs raised over $7 Billion. This shows that ICO is a viable method of crowd funding to bring new technological ideas into reality. However, while ICOs raised a great deal of fund, it also gave birth to a variety of scams and legal concerns.

What is STO?

As explained in the inwara.com study, a Security Token Offering (STO) is: Financial security issued as a digital asset; which generally represent proprietary rights in an underlying company and/or its assets. This is distinctly different from ICOs, which are “utility tokens” or digital tokens giving access to the future product/service of a project with no real right to an asset or equity interest.

An ICO provides tokens that do not give any rights/obligations, but offers access to a specific network, platform or service. In contrast to this, tokens offered in an STO are actual financial securities that are backed by something tangible such as the profits, assets, or revenue of an organization, and they offer legal rights such as voting.

It is obvious that STOs will open the door to a whole new set of opportunities for the blockchain industry. For example, traditional organizations will be able to host their own STOs as more and more traditional assets will become tokenized and move to the blockchain. STOs will prove to be the bridge that the finance industry and the blockchain desperately required to have a point of convergence.

The Future…

In a nutshell, we can say that blockchain is developing and many organizations visualize a bright future in its implementation. Furthermore, the potential applications of blockchain technology are growing exponentially because of the fact that almost anything involving transactions or digital assets can be placed on a blockchain. When it comes to the future, one thing is for sure… Our online lives will count on blockchain without many of us even being fully aware of it.

Blockchain can transform many things, but at present, the technology is still shaping. Many think that it can help get rid of giant-companies omnipresence, but I am not sure without they being included in it how it is going to become a part of every industry.

A must-read list for all the blockchain and cryptocurrency enthusiasts out there!